Martinez, CA – Please be advised that the “2023-2024 Assessor’s Close of Roll Affidavit” was signed by Gus S. Kramer, Assessor, and subscribed and sworn to the County Clerk-Recorder’s Office, on June 30, 2023.

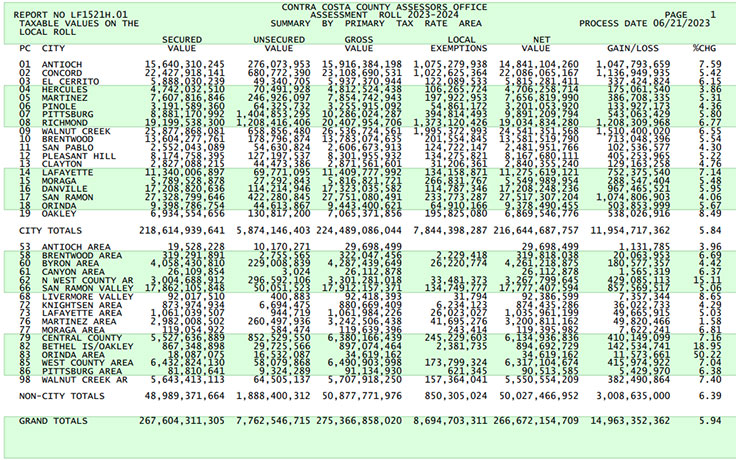

The 2023-2024 Assessment Roll has been delivered to the County Auditor, as required by law. The increase to the local tax base for 2023-2024 is over $14.96 billion. This represents a 5.94% increase in assessed value and brings the total net local assessment roll to more than $266.67 billion.

The 2023-2024 assessment roll is the highest to date in Contra Costa County’s history. Cities with the largest increases in assessed value include Oakley, Antioch, and Lafayette with increases ranging up to 8.49%. San Pablo, San Ramon, and Hercules saw the lowest assessed value increases ranging from 4.30% down to 3.86%.

The assessment roll now consists of 379,442 parcels, an increase of 1,202 over the previous year. The Assessor’s annual letter to the Board of Supervisors and 2023-2024 Assessment Roll Reports can be found at: 2023-2024-BOS-Close-of-Assessment-Roll-Letter-and-Reports-to-the-CCC-Board-of-Supervisors (ca.gov)

2022-2023 Contra Costa County Assessment Roll

The 2022-2023 Assessment Roll has been delivered to the County Auditor, as required by law.

The increase to the local tax base for 2022-2023 is over $18.21 billion. This represents a 7.79% increase in assessed value and brings the total net local assessment roll to nearly $251.71 billion. The 2022-2023 assessment roll is the highest to date in Contra Costa County’s history.

Cities with the largest increases in assessed value from the prior year include Oakley with a 16.48% increase, Pittsburg with a 12.35% increase, and Brentwood with a 9.23% increase. San Ramon and Hercules saw the lowest assessed value increases―San Ramon at 5.98% and Hercules at 5.12%. The assessment roll now consists of 378,240 parcels, an increase of 1,275 over the previous year.

3 comments

California is going to have to re-think the way of taxes, and specifically property tax. The fundamental problem is two fold: on the one side you have a state in constant hunger with almost guaranteed year-over-year tax increases while on the other side you have a very stark fact: people are leaving California, exactly because of taxes!!!

If we don’t figure this out better, the remaining population will not just be paying for themselves, but also for all that have left!!!

People leaving California is not such a problem. EMPLOYERS leaving it definitely is – and that is due not only to taxes but to the nanny-state overreach of the progressive left supermajority.

Quit giving free stuff to those who do not contribute to the betterment of society, or who are otherwise not deserving (like illegals).

Comments are closed.